If you work in local government finance, you’ve probably stopped asking when things will “go back to normal.” Financial strain in local government has become the new normal for public sector finance professionals and city leaders.

Because this is normal now.

The latest National League of Cities City Fiscal Conditions report puts data behind what many municipal finance leaders already feel every day: revenues aren’t collapsing, but they aren’t keeping up either. Costs keep rising. Labor is more expensive. Infrastructure needs don’t wait for better timing. And funding from higher levels of government remains uncertain, competitive, and often late.

This isn’t a sudden crisis. It’s a slow squeeze.

What makes it so difficult is that nothing is technically “broken.” Budgets are balanced. Processes still function. But year after year, the margin for error gets smaller. Small gaps turn into recurring problems. And the room to plan ahead keeps shrinking.

It’s important to say this out loud: this isn’t happening because cities and counties are mismanaged. It’s structural. Inflation impacts public services differently than private sector organizations. Community expectations are higher than ever. And the traditional revenue tools local governments rely on simply don’t grow fast enough to absorb constant cost pressure.

The National League of Cities report reflects a growing unease among city leaders. Confidence in long-term financial outlooks is slipping. Forecasting feels harder. Planning feels riskier. And each budget cycle starts to feel less like strategy and more like survival.

Beyond the Balance Sheet: The Human Cost of Financial Strain in Local Government

Numbers tell part of the story. The rest lives inside city halls and county offices.

It shows up when budget assumptions are outdated almost as soon as they’re approved. When departments are asked once again to revise projections midyear. When finance teams are juggling vacancies, tighter timelines, and more scrutiny, all at once.

It also shows up emotionally.

Public finance professionals care deeply about their communities. They know that every delay, every cut, every tradeoff has real consequences. But when uncertainty becomes constant, decision-making turns reactive by default. Instead of asking “What’s the best long-term choice?” leaders are forced to ask “What can we realistically manage right now?”

That takes a toll.

Burnout isn’t just about long hours. It’s about the feeling that no matter how careful you are, the ground keeps shifting. It’s about wanting to plan ahead but not having the tools, data, or certainty to do it confidently.

And over time, that constant pressure erodes more than budgets. It erodes momentum.

How Can GovTech Enhance Fiscal Resilience? Reframing Financial Strain in Local Government with the Financial Flywheel

Here’s the hard truth: many of today’s fiscal challenges are made worse by fragmentation across financial systems.

Budgets live in one system. Grants in another. Procurement data somewhere else. Payments and revenue tracking somewhere else entirely. Each system works on its own, but together, they leave leaders without a clear, real-time picture of what’s actually happening.

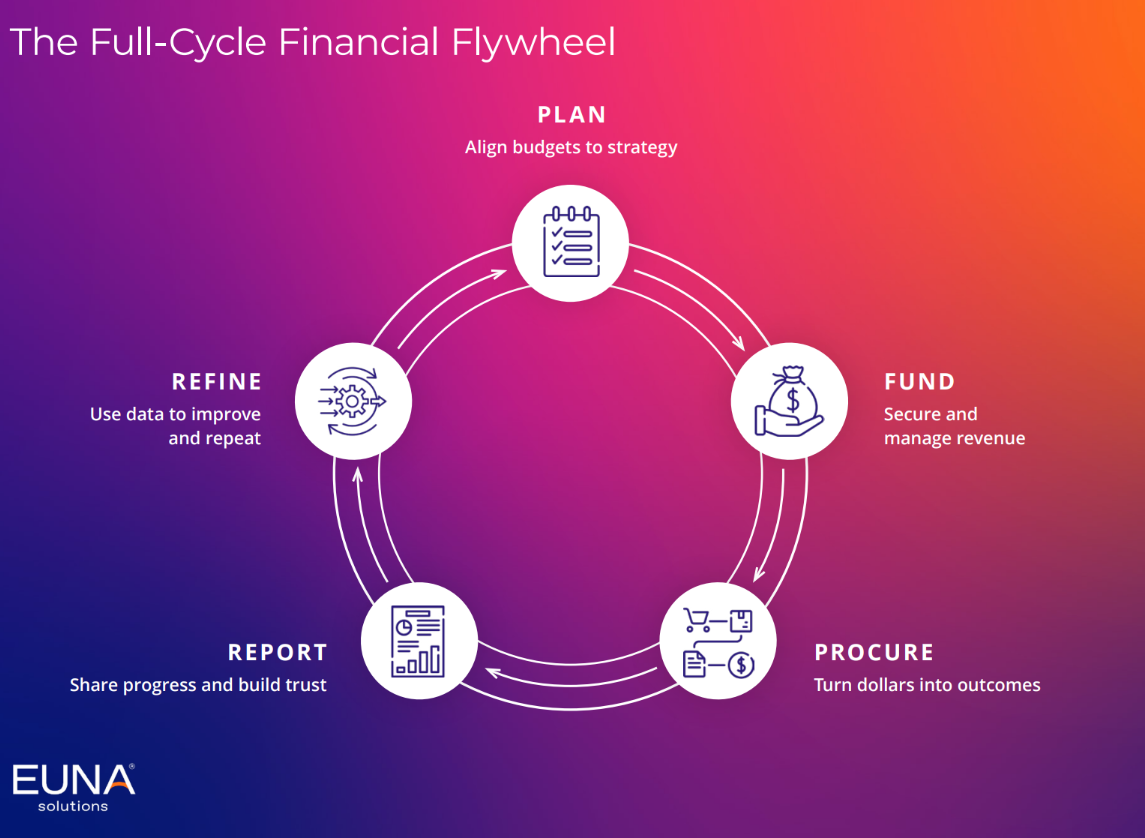

The Euna Solutions® From Financial Strain to Community Gain eBook introduces a simple but powerful way to think about this: the financial flywheel.

The idea is that planning, funding, spending, collecting, and reporting aren’t separate activities. They’re connected. And when they’re disconnected in practice, agencies lose visibility. When visibility disappears, agility goes with it.

Resilience doesn’t come from cutting deeper or pushing teams harder. It comes from connection. From seeing how decisions in one area ripple across the rest of the organization and being able to respond before small issues become major problems.

That’s the shift GovTech makes possible. Not by fixing one problem at a time, but by changing how the whole system works together.

From Reactive to Resilient: Putting the Financial Flywheel into Action

In practice, resilience looks less like a single initiative and more like a series of small, compounding changes.

It starts with budgeting that isn’t frozen in time. Scenario planning allows leaders to test assumptions, model “what if” moments, and adjust without starting over every time conditions change.

It shows up in how grants are managed. When funding is treated as strategic rather than opportunistic, teams can pursue the right opportunities earlier, manage compliance more confidently, and avoid the last-minute scramble that drains time and energy.

It shows up in procurement, too. When purchasing decisions are connected to budget reality, agencies can respond faster to price volatility, make smarter tradeoffs, and avoid surprises that derail financial plans.

Revenue collection matters just as much. Modern payment systems don’t just make life easier for residents. They improve cash flow, forecasting, and trust. When people can pay easily, agencies get paid faster. When data flows back into planning, leaders make better decisions.

And finally, it all comes together through transparency. Not as a reporting exercise, but as a leadership practice. When stakeholders can see how dollars connect to outcomes, confidence grows, even in uncertain times.

Leading Through Uncertainty: The Future of Financial Strain in Local Government

None of this makes uncertainty disappear.

Budgets will still be tight. Costs will still rise. Community needs will keep growing. That’s reality.

But local governments aren’t powerless.

By adopting a connected, full-cycle approach to public finance—one that aligns planning, funding, spending, and reporting—leaders can regain control over what is within their reach. They can move from reacting to circumstances to leading through them.

That’s where Euna Solutions fits. Not as a promise to eliminate challenges, but as an enabler of better decisions, clearer visibility, and stronger alignment across the entire financial ecosystem.

The goal isn’t to escape the squeeze. It’s to build systems and teams that can withstand it.

Key Takeaways

Structural Challenge: Financial strain in local government is a persistent, systemic issue, not a temporary crisis.

Human Impact: Ongoing uncertainty and resource constraints affect both morale and long-term planning for public finance professionals.

Tech-Driven Resilience: GovTech solutions like the financial flywheel can help unify fragmented systems and improve fiscal agility.

Full-Cycle Visibility: Connecting budgeting, grants, procurement, and revenue collection enhances transparency and decision-making.

Leadership Response: Local governments can lead through uncertainty by adopting connected, resilient financial practices.

Conclusion

To address financial strain in local government, leaders should focus on integrated, technology-enabled systems that build resilience and allow for proactive fiscal management, rather than waiting for a return to past norms.

FAQ

What is financial strain in local government and why does it persist?

Financial strain in local government refers to the ongoing challenge of balancing rising costs, limited revenue growth, and increased community expectations. This situation persists due to structural issues, such as inflation and outdated revenue tools, rather than mismanagement.

Where can local government finance teams find resources to help manage financial strain?

Finance teams can explore resources from entities like the National League of Cities and technology providers such as Euna Solutions, which offer reports, eBooks, and integrated platforms designed to address fiscal resilience and financial strain in local government.

How can local governments take action to address financial strain?

Agencies can implement scenario planning, modernize payment systems, and adopt connected GovTech solutions to improve visibility, agility, and fiscal resilience. These steps help manage financial strain in local government more proactively.

What should leaders consider when evaluating solutions for financial strain in local government?

Leaders should compare technology options based on their ability to unify budgeting, grants, procurement, and revenue systems. Solutions that offer full-cycle visibility and support strategic planning can best address ongoing financial strain in local government.