Nowadays, economic uncertainty has become the norm rather than the exception. And for government finance leaders, this isn’t just a headline but a daily operational challenge. Inflation runs hot, interest rates pivot unexpectedly, and revenue projections swing back and forth like a pendulum. In this volatile environment, traditional budgeting approaches are showing their age.

But there’s good news. Forward-thinking public sector finance teams are adapting with tools and techniques that embrace flexibility rather than resist it. Chief among them? Rolling forecasts, scenario modeling, and digital budget platforms built for agility.

Let’s dig into how finance leaders are moving from fog-bound projections to clearer, more responsive planning through budget forecasting.

The Problem with Static Budgets

Most public sector organizations still rely heavily on static, annual budgeting processes. These budgets often take months to create, require intensive stakeholder coordination, and are commonly already out of date by the time they’re finalized.

This sort of rigidity, however, becomes a liability in today’s dynamic and unpredictable environment. Consider just a few of the challenges:

Locked-in, outdated assumptions

By the time a static budget is finalized, assumptions about costs like fuel, labor, or expected tax revenues may already be outdated. In fast-moving environments, economic conditions shift quickly, and fixed budgets don’t account for these changes. This leaves teams stuck working with figures that no longer reflect reality, forcing tough choices later in the year when the numbers no longer add up.

Little flexibility when actuals diverge from plans

Once adopted, static budgets often become politically and administratively difficult to revise. Even when actual revenues come in lower than expected—or costs surge due to inflation—many public sector finance teams are left scrambling to adapt. The typical result? Rushed budget amendments, short-term patches, or painful cuts, none of which support strategic or transparent decision-making.

Encourage reactive adjustments instead of proactive strategies

One of the worst side-effects of static budgets is that it forces organizations into a “wait-and-see” posture. Instead of adjusting dynamically to real-time data, teams are compelled to simply react when things go off the rails. This, of course, leads to a firefighting situation where staff are scrambling to solve problems that could’ve been anticipated with a more flexible, iterative planning process. Reactive budgeting also makes it harder to communicate changes to stakeholders, eroding confidence and trust.

The Power of Rolling Forecasts

Rolling forecasts offer a more agile alternative. Rather than setting a fixed annual budget, rolling forecasts update on a regular monthly or quarterly cadence based on the latest financial and operational data.

Here’s what that looks like in practice:

This approach allows for continuous re-planning, helping finance leaders spot emerging issues and opportunities early.

In the unpredictable climate of the public sector, this is especially valuable. Federal and state policy shifts, economic development trends, and even extreme weather events can quickly alter financial landscapes. Rolling forecasts help teams stay ready rather than reactive.

Use Case: Managing Operating Budgets in a High-Inflation Environment

A county government’s finance team adopted rolling forecasting to manage its general fund, which supports public safety, libraries, and transit. With inflation driving up personnel and vendor costs, their original annual budget quickly became obsolete.

By shifting to quarterly rolling forecasts, the team could:

- Reassess spending categories in real time.

- Identify early signs of budget overruns.

- Reallocate funds mid-year to avoid service cuts.

Rather than waiting until year-end for a painful reconciliation, they course-corrected early—preserving both their financial stability and public services.

Key Benefits of Rolling Forecasts:

- Early warning system for overspending or revenue shortfalls.

- Improved decision-making for mid-year allocations.

- Reduced reliance on budget amendments, which can be politically sensitive.

Scenario Planning: Managing the What-Ifs

While rolling forecasts provide regular updates, scenario planning prepares you for multiple futures.

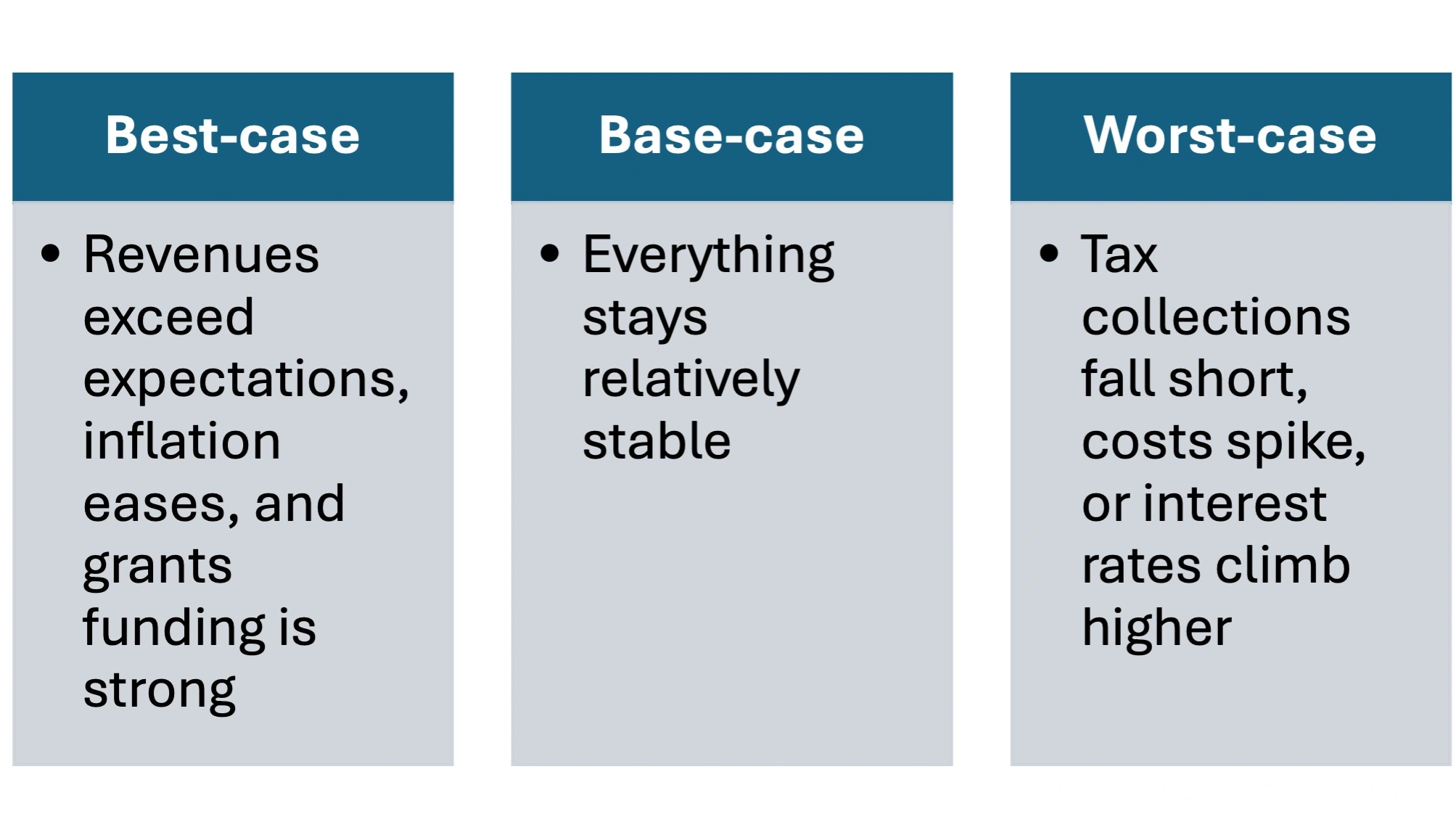

Think of it as budgeting in parallel universes. A finance team might build three core models:

By exploring the impact of each scenario, finance leaders can:

- Identify early warning signs.

- Build contingency plans.

- Communicate risks transparently to leadership and elected officials.

Scenario planning is not about guessing the future. It’s about building a resilient financial model and knowing how it will hold up under stress.

Use Case: Forecasting Grant Funding Scenarios for a City Housing Department

A city housing department faced uncertainty over the renewal of a federal grant that covered 30% of its affordable housing program. The finance team used scenario planning to compare three situations:

- Scenario A: Full grant renewal.

- Scenario B: Partial funding (50%).

- Scenario C: Zero renewal.

For each possible outcome, they modeled downstream effects such as staff impacts, project delays, service reductions, and required offsets. This let the department:

- Communicate risks clearly to city council.

- Pre-build contingency plans.

- Request bridge funding proactively.

Scenario planning gave them not just foresight, but leverage, helping them get what they needed from city council before a problem arose.

Other Examples of Scenario Modeling in Government:

- Modeling the revenue impact of a new tax policy before adoption.

- Planning for interest rate spikes affecting bond-funded infrastructure.

- Estimating the fiscal impact of population growth or decline on school funding formulas.

Why Digital Tools Are Critical

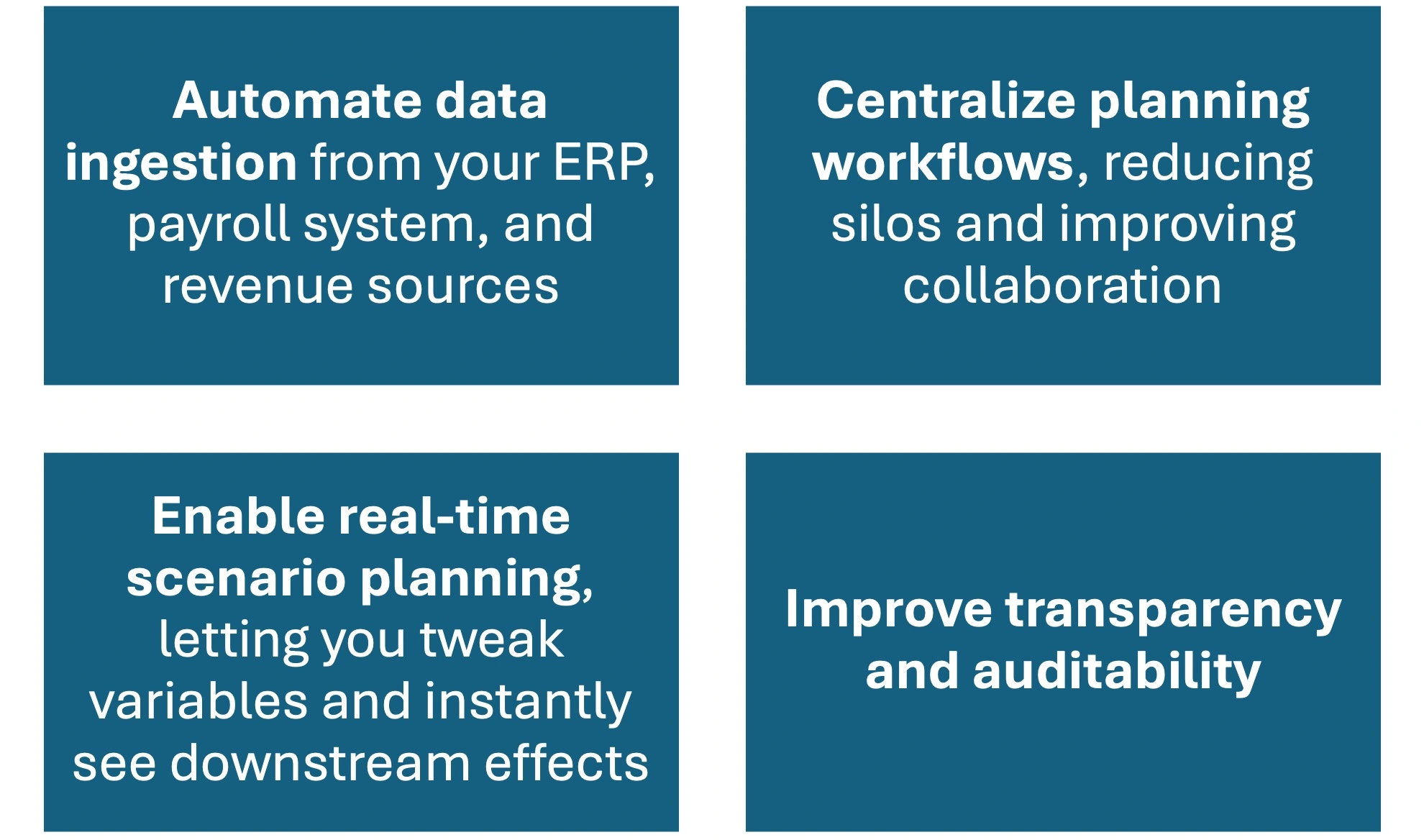

While powerful in theory, rolling forecasts and scenario planning can be painful to manage in spreadsheets. The reality for many public finance teams is version control chaos, manual data entry, and cross-department confusion. This is where modern digital budget platforms come in.

How Digital Budget Tools Work

In short, digital tools turn budgeting from a once-a-year slog into a continuous, strategic function. And during uncertain times, that agility is an essential asset to have.

Making the Shift: 4 Tips on Where to Start

If your team is still anchored in a static budgeting process, here’s how to begin evolving:

- Assess your current tools. Are your systems capable of supporting rolling forecasts and scenario planning? If not, it may be time to invest in purpose-built software.

- Start small. Introduce rolling forecasts in a pilot department or fund. Learn what works and expand gradually.

- Build stakeholder buy-in. Budgeting is political in government. Engage department heads, leadership, and elected officials early. Emphasize transparency and adaptability.

- Train your team. Even the best tools fail without knowledgeable users. Provide support and professional development around forecasting, scenario planning, and interpreting financial trends.

5 Key Takeaways

- Static budgets are too rigid for today’s economic volatility.

- Rolling forecasts help you update plans continuously and respond to new data.

- Scenario planning prepares your team for best-case, worst-case, and everything in between.

- Digital budgeting tools eliminate manual headaches and turn planning into a strategic strength.

- Government finance leaders who adopt these practices gain flexibility, foresight, and confidence in decision-making.

Forecasting in a fog isn’t about perfect clarity—it’s about building a system that adapts as the weather changes.

Finance teams that embrace rolling forecasts, scenario planning, and digital tools are positioning themselves for smarter, more agile decision-making. In an era of constant uncertainty, that’s the edge public sector leaders need.

Ready to Build a More Agile Budget?

Euna Budget helps public sector finance teams ditch outdated spreadsheets, embrace rolling forecasts, and plan for what-if scenarios with ease. Whether you’re dealing with volatile revenues, unpredictable grants, or shifting policies, Euna Budget gives you the agility to lead with confidence.

Learn more about Euna Budget and schedule a personalized demo today.